Fast Online Loans From $100-$5,000 In Canada

Simplify Your Loan Search, We Connect You With Fast Online Loans In Canada.

- * No Credit Checks

- Get Up To $5,000

- Fast Approvals

- Direct Deposit

How Does It Work?

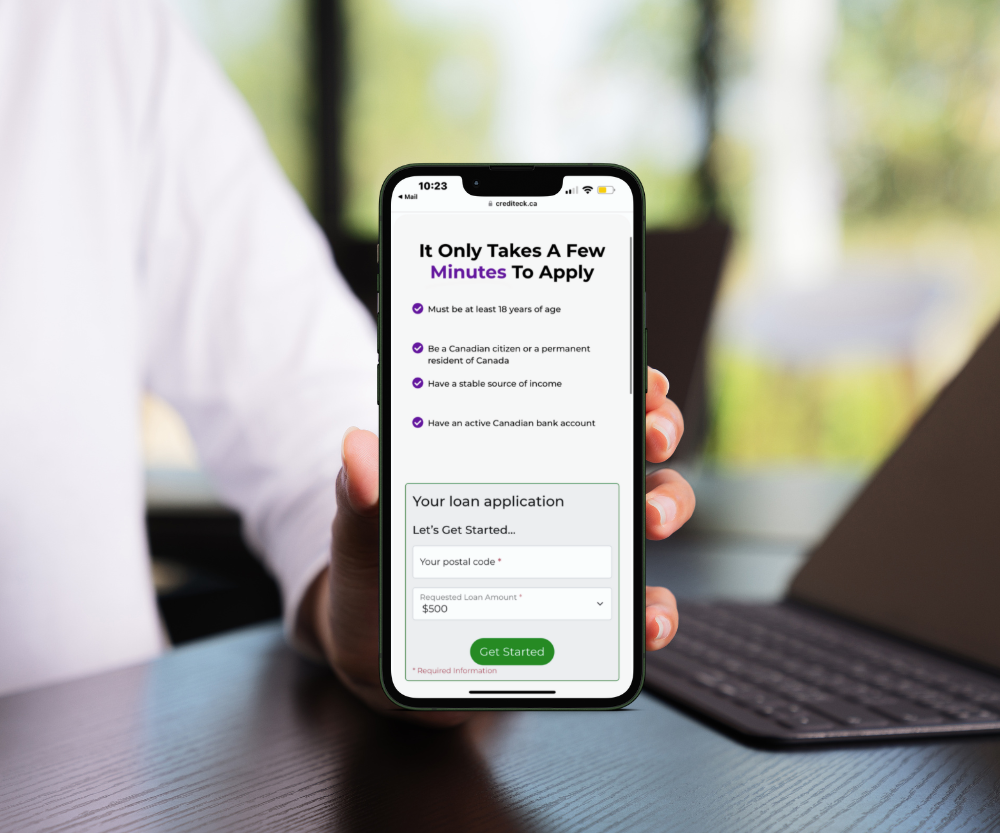

Apply Online

Fill out as many details as possible on your application to speed up the process and receive your money faster.

Verify Details

Upon pre-approval, you will be directed to a link to connect your bank account.

Review & Sign

Upon approval, review and sign loan offer from Lender.

Receive E-transfer

Receive money VIA E-Transfer and make scheduled payments.

Simple & Fast Online Loans In Canada

Through our platform you can access fast online loans when you need emergency financial relief. We connect your application with our network of Canadian lenders, giving you a high chance of getting approved.

Why choose crediteck?

Increase Your Approval Odds with our Direct Lender Network in Canada! At Crediteck, we understand the importance of securing a short-term installment loan when you need it most. That’s why we have built a strong network of direct lenders across Canada to connect you with the right loan options. When you choose Crediteck, you benefit from the following advantages:

Exclusive Lender Network

We put your application directly in front of our network of reputable lenders in Canada. By leveraging our established relationships, we increase your chances of getting approved for the loan you need.

Easy Verification Process

Once you complete our online application and receive a pre-approval, we expedite the process by seamlessly redirecting you to a lender. Through instant bank verification, you can quickly and securely verify the details you have provided, ensuring a smooth loan application experience.

Trusted & Reliable

With Crediteck, you can trust that your loan application is in capable hands. We prioritize your privacy and security, adhering to strict industry standards to safeguard your personal information throughout the entire process.

see what customers are saying

Zach Heginson2021-01-20I got approved and had money deposited in my account on same day. Fast and easy process.

Zach Heginson2021-01-20I got approved and had money deposited in my account on same day. Fast and easy process. Mark Tremblay2021-01-07After using a few services like this, and mostly being disappointed in the past, I can say for the first time that Crediteck was professional and the way it should be.

Mark Tremblay2021-01-07After using a few services like this, and mostly being disappointed in the past, I can say for the first time that Crediteck was professional and the way it should be. David Sinclair2021-01-05While visiting Toronto I was relieved to find Crediteck. I had some unexpected expenses and they saved the day. Great service. If I ever have the need for quick cash I would use Crediteck again

David Sinclair2021-01-05While visiting Toronto I was relieved to find Crediteck. I had some unexpected expenses and they saved the day. Great service. If I ever have the need for quick cash I would use Crediteck again

Frequently asked questions

Short-term loans generally range in the area of $100 – $5,000. Dependent on the information in your application, the lender decides the amount you are qualified to receive. This amount is typically subject to increase as you successfully repay your online loans in the allotted time period.

Bad credit will not automatically disqualify you for a short-term loan. Lenders take various factors into consideration when they review and approve your loan application.

Upon approval, the majority of short-term online loans acquired through Crediteck are delivered to you electronically within a period of 24 hours, not including weekends or holidays.

Crediteck prides itself in delivering fast approvals because we understand the importance of receiving your loan rapidly in the event of financial emergencies.

Payday lenders do not usually do a ‘hard’ credit check using credit bureaus, but will often ensure information provided is accurate.

We Have Helped Thousands Of Canadians Find Online Loans

Simply use our online application to get pre approved, If you are approved you will be redirected to an instant bank verification page to verify your details with a lender who wants to work with you.