About Us

We are those who have a goal to help people in emergency and solve their short term but urgent cash problems offering them a responsible and quick solution. We are in some way transforming the credit market of Canada by offering people small online loans for short term. Such loans are much more quick, convenient and flexible than ones that other websites or Canadian banks can offer. We really try to remove all these complex procedures Canadian consumers face when they are in urgent need to borrow some money. As we really understand the importance of urgent cash for our consumers, all the operations concerning applying, being approved and getting the loan are performed online. We are really quick and extremely convenient. Try yourself!

Why choose crediteck?

Increase Your Approval Odds with our Direct Lender Network in Canada! At Crediteck, we understand the importance of securing a short-term installment loan when you need it most. That’s why we have built a strong network of direct lenders across Canada to connect you with the right loan options. When you choose Crediteck, you benefit from the following advantages:

Exclusive Lender Network

We put your application directly in front of our network of reputable lenders in Canada. By leveraging our established relationships, we increase your chances of getting approved for the loan you need

Easy Verification Process

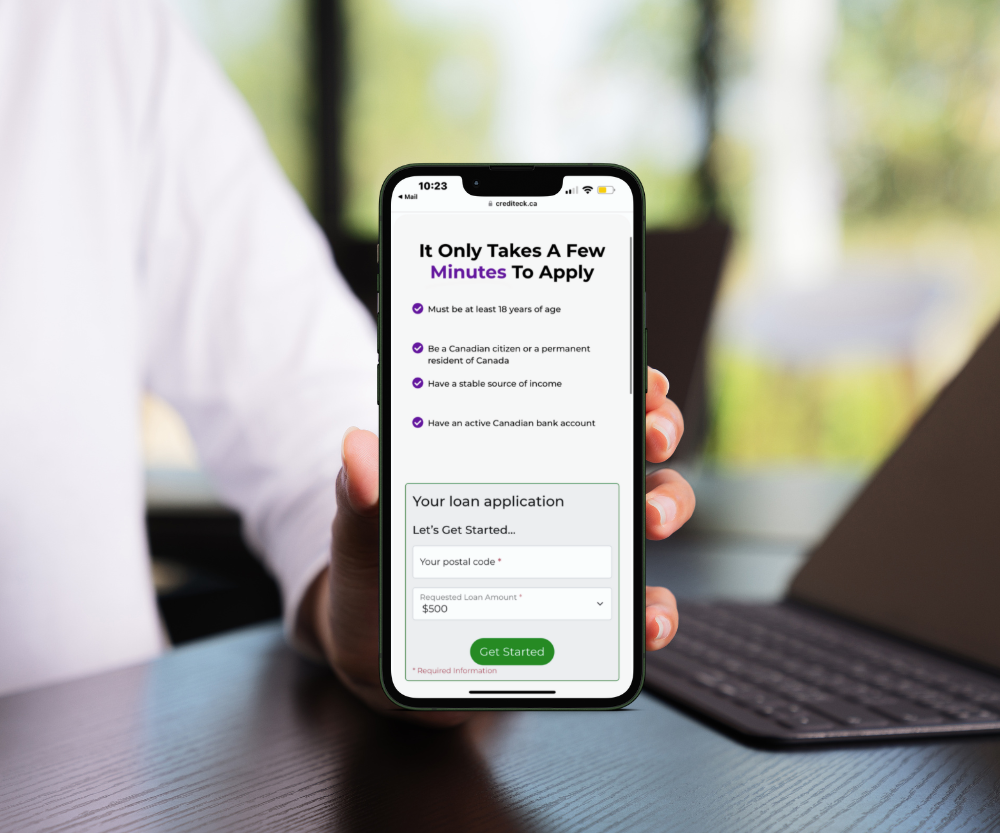

Once you complete our online application and receive a pre-approval, we expedite the process by seamlessly redirecting you to a lender. Through instant bank verification, you can quickly and securely verify the details you have provided, ensuring a smooth loan application experience.

Trusted & Reliable

With Crediteck, you can trust that your loan application is in capable hands. We prioritize your privacy and security, adhering to strict industry standards to safeguard your personal information throughout the entire process.

.

We Have Helped Thousands Of Canadians Find Online Loans

Simply use our online application to get pre approved, If you are approved you will be redirected to an instant bank verification page to verify your details with a lender who wants to work with you.