What Is a Payday Loan?

Payday loans are a short-term borrowing solution intended to help you cover immediate expenses. If you have urgent car repairs, medical bills, or everyday expenses that you need to cover, a payday loan can provide quick cash when you need it most. The application process has never been easier. Crediteck could connect you with online payday lenders across Canada. Note: based on the details of your application, you could get connected with online installment lenders rather than online payday lenders.

The Cost of Living in Alberta

According to a recent poll, cost of living is the top issue for Albertans. Sixty-nine percent (69%) of respondents said that cost of living and inflation are their biggest worry. The same survey suggests that 39% of Albertans are struggling financially while 26% are uncomfortable. Only 17% are comfortable and only 19% are thriving financially. The proportion of those struggling financially in Alberta is higher than the national average, which stands at 31%.

Moreover, according to a survey completed on behalf of the Alberta Federation of Labour, 87% of the respondents reported having significant challenges in making ends meet from week to week. Additionally, over half of low-income or working-class Albertans are very worried about ever achieving a middle-class lifestyle. The living wage in Alberta varies from $23.70 per hour in Calgary to a whopping $38.80 in Canmore. Out of the sixteen municipalities considered, Medicine Hat had the lowest living wage at $17.35 per hour, which is still higher than the new minimum wage of $15.00 per hour. The new minimum wage came into effect in Alberta on April 1, 2024.

How Payday Loans Can Help in Alberta

If you’re stuck without sufficient cash between paydays, an online payday loan can provide emergency funds you need to cover immediate expenses. Apply online via Crediteck. Based on your application, you may get connected with online installment lenders rather than online payday lenders. We don’t check your credit score during our online application process!

5 Ways to Improve Your Financial Health in Alberta

Despite the ongoing cost-of-living crisis, there are several ways to improve your financial health in Alberta:

- Create a budget. This is perhaps the most important tip. The common guideline is to allocate about 50% of your income toward needs, 30% toward wants, and 20% toward saving and debt repayment. If that is not realistic, try a different breakdown. The main point is to allocate your income with a purpose in mind.

- Increase your income. This can be tricky, but it’s never been easier to learn new skills! Take online courses, attend bootcamps, or learn a trade. You could be making more money in no time.

- Consider debt consolidation. Then you will have only one monthly payment to worry about, possibly at a lower interest rate.

- Build an emergency fund. Aim to have at least three months’ expenses saved up – and ideally six to nine months’ worth of expenses – in case of emergencies like sudden job loss, medical problems, car repairs, and so on.

- Save and invest regularly. Given today’s cost-of-living crisis, it’s harder than ever to save money. However, if you can set aside even a small amount of weekly or monthly savings, that can get you started on the right road.

Bonus tip: monitor your credit score and improve your credit health with Credit Verify! Sign up today.

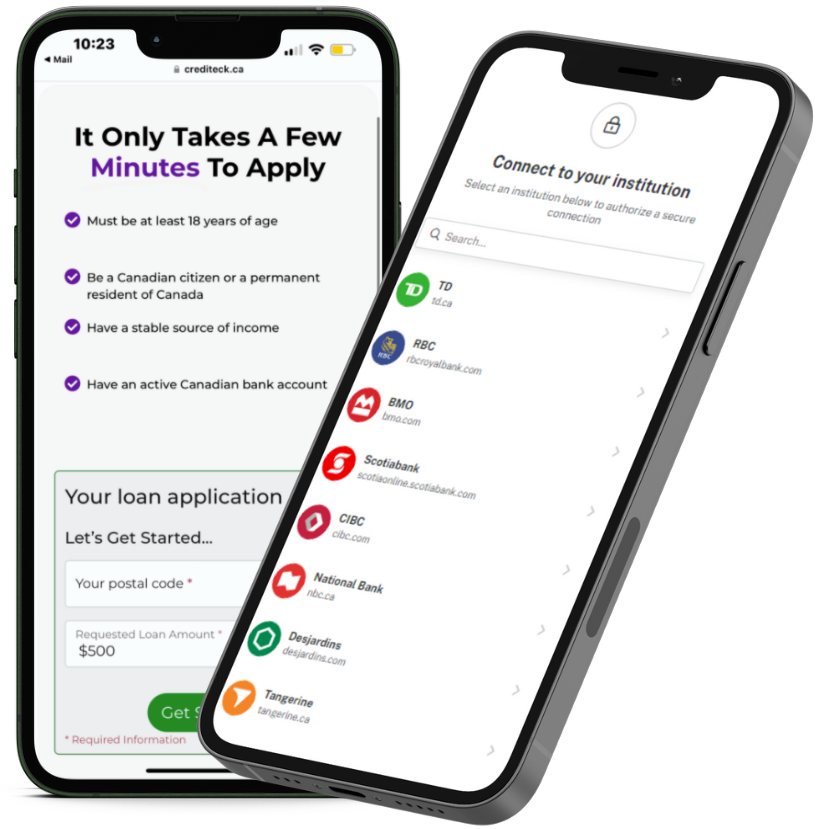

What You Need to Qualify for Online Payday Loans in Alberta

You need to meet the following criteria:

- At least 18 years of age

- Canadian citizen or permanent resident

- Permanent address

- A proof of consistent income

- Have a valid Canadian bank account that has been active for at least 90 days

Minimize your NSF transactions and ongoing payday loans or short-term loans to improve your chances of approval.

Conclusion

It’s never been easier to access payday loans. Our online application process takes only a few minutes. You will get an immediate response. Based on the details of your application, you may get linked with online installment lenders rather than online payday lenders. Apply online now! We do not do credit checks during our online application process.