A Soaring Cost of Living

Nova Scotia is the second most densely populated province in Canada with the second smallest land area and almost one million residents. Ranked sixth in terms of the highest cost of living in Canada, this province has the fifth-highest median house price.

A comfortable living wage in Nova Scotia would be somewhere between $22.85-26.50 per hour – less than you would need, on average, in places like Ontario and British Columbia, but far more than the minimum wage. The minimum wage in Nova Scotia is just $15.20 per hour. The cost of housing has risen across Canada, and Nova Scotia is by no means an exception to that rule. The average monthly rent for a one-bedroom apartment has gone up to over $2,100, which is an almost untenable burden for any low-paid worker. Over the years, the cost of groceries has skyrocketed in this province as elsewhere in Canada. Overall, the prices of most necessities have been soaring in this province.

How Can a Personal Loan Help in Nova Scotia?

When you run out of cash between paydays or need to cover an urgent expense, a personal loan can provide quick financial relief. We do not check your credit score or credit report as part of our online application process. Apply online now and get connected with online installment lenders across Nova Scotia. You will receive an immediate response and may have funds deposited in your bank account in as little as 24 hours.

Requirements to Get a Personal Loan in Nova Scotia

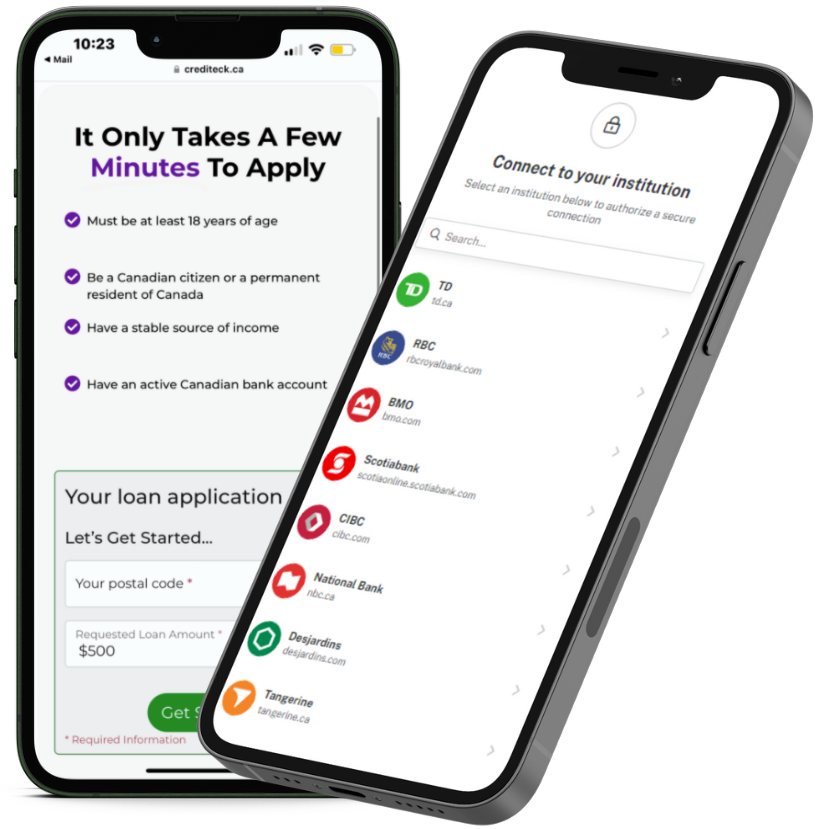

There are some basic requirements you need to meet to qualify for a personal loan:

- 18 years of age or older

- Canadian citizen or permanent resident

- Permanent address

- Consistent income

- Valid Canadian bank account that has been active for at least 90 days

While we do not perform credit checks as part of our application process, you may wish to know your credit score for many transactions, such as rental applications or mortgage approvals. To check your credit score or credit report, register online with Credit Verify! Registration takes only a few minutes, giving you immediate access to personal financial information and benefits.

Instant Bank Verification (IBV) and Personal Loans in Nova Scotia

Canadian lenders use Instant Bank Verification (IBV) to confirm your application details and bank account and to determine whether you qualify for a personal loan.

Tips to Help You Get Approved

Here are some helpful tips to follow to maximize your chances of getting approved:

- Keep NSF transactions to a minimum

- Keep the number of active payday loans or short-term loans as low as possible

- Maintain a consistent source of income

- Have an active Canadian bank account that has been active for at least 90 days

Benefits of a Personal Loan in Nova Scotia

- Access immediate financial relief

- Help cover urgent expenses

- Follow a predictable repayment schedule

Downsides of a Personal Loan in Nova Scotia

- You may be charged additional fees if unable to make payments on time

What Sources of Income Are Acceptable?

Any of the following sources of income will help you qualify for a personal loan in Nova Scotia:

- Employment income

- Self-employment income

- Government benefits

Level Up Your Financial Game in Nova Scotia

Despite the ongoing cost-of-living crisis, there are many different ways in which you could potentially improve your financial performance in Nova Scotia:

- Set financial goals. Whether it’s a certain income level, a savings target, or a debt repayment goal, setting clear goals will help you measure your progress and stay on track. Come up with an actionable plan to achieve each one of your financial goals and work steadily towards accomplishing it.

- Build an emergency fund. Set aside some money each month to put into your emergency fund. Ideally, you would have at least three months’ expenses saved up in case of an unforeseen setback.

- Consider debt consolidation. Debt consolidation may help you have just one monthly payment for all of your debts, at a lower interest rate. This may help reduce your overall stress levels and make your payments more manageable.

- Cut down on unnecessary expenditures. Consider whether some of your expenses can be avoided. For example, if you have an expensive Starbucks habit, you may want to cut down on it while you get back on your feet financially.

Get a Personal Loan No Credit Check in Nova Scotia

When you’re in acute financial need, a personal loan can provide the financial assistance you require. Consider applying online via Crediteck. Personal loans offer longer repayment terms, rather than just getting you to your next payday with payday loans. We will instantly connect you with online installment lenders across Canada, and we do not check your credit score or credit report during our online application process. You may get funds deposited into your bank account in as little as 24 hours!