What Are E-Transfer Personal Loans in Ontario?

E-transfer personal loans in Ontario offer quick cash for a variety of expenses. You can apply for e-transfer personal loans online via Crediteck and receive an immediate response. In addition, you will receive your funds via e-transfer – a simple, quick, safe, and secure online transaction. Unlike payday loans, personal loans offer a longer and more manageable repayment period, taking the pressure off your next payday and giving you greater flexibility.

Obtain E-Transfer Personal Loans in Ontario Now

E-transfer personal loans in Ontario provide a quick financial solution for everyday Ontarians. If you are in a financial pinch, these types of loans can provide the assistance you need to help you get back on your feet.

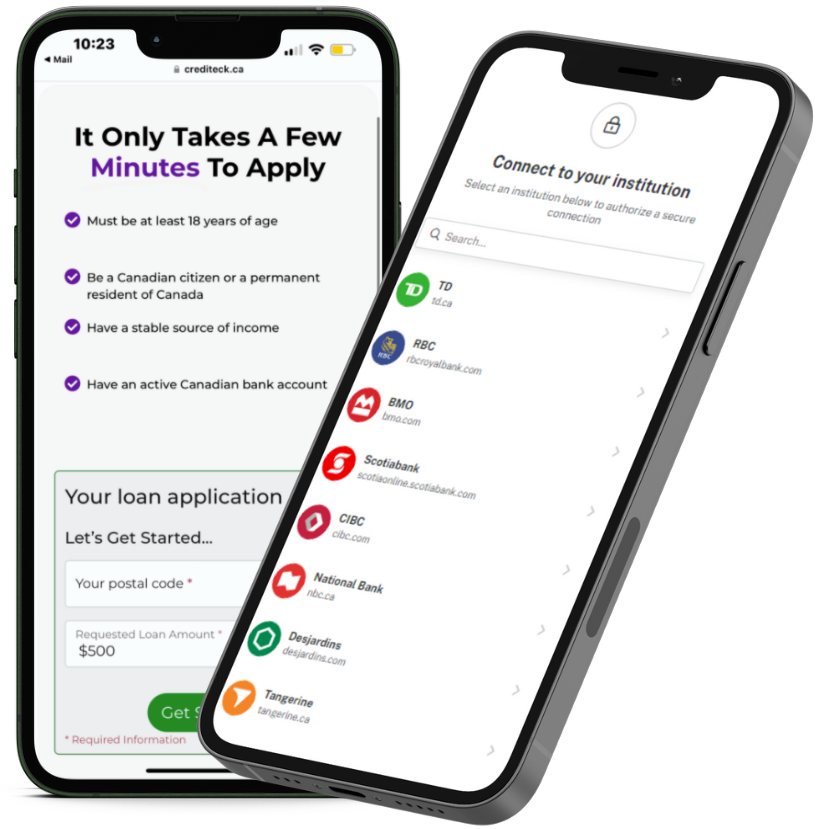

Just submit a quick online application via Crediteck. You may get your funds deposited in as little as 24 hours via e-transfer, allowing you to cover immediate expenses.

When Is the Right Time to Apply for E-Transfer Personal Loans?

These types of personal loans are perfect for covering immediate and/or urgent expenses, particularly if you are short on cash between paydays. You can use the funds to cover a wide variety of expenses, including the following:

- Urgent car repairs

- Medical bills

- Rent

- Groceries

- Purchases

- Other everyday expenses

If you’re out of cash between paydays or need emergency financial assistance, consider applying for online e-transfer personal loans in Ontario via Crediteck. Our online application process is simple and easy, and you may get funds deposited as soon as the next day.

Can I Qualify for E-Transfer Personal Loans with a Low Credit Score?

The online lenders we work with generally do not check credit scores or credit reports. Instead, they may use Instant Banking Verification (IBV) to confirm your application and banking details. Therefore, even with a less-than-perfect credit history, you may still be able to obtain e-transfer personal loans online easily.

That being said, it’s always best to improve your credit score to the extent that you can. To level up your credit score, consider signing up for Credit Verify! The registration process takes only a few minutes and allows you to track your credit score and detect any mistakes on your credit report.

What Are the Requirements to Apply for E-Transfer Personal Loans in Ontario?

There are a few basic requirements for Ontarians:

- You must be at least 18 years of age.

- You must be a Canadian citizen or permanent resident.

- You must have a permanent address.

- You must have a consistent income.

- You must have a Canadian bank account that has been active for at least three months or 90 days.

In addition, it helps to keep your NSF transactions and active payday loans/short-term loans to a minimum. If you consider that low credit scores are not an obstacle to applying for these types of loans, it may be easier to qualify for e-transfer personal loans than ever before. No in-person appointments are needed with our quick and easy online application process!

What Are the Benefits of E-Transfer Personal Loans in Ontario?

E-transfer personal loans in Ontario offer several benefits and advantages:

- As the name implies, the funds are deposited via e-transfer. This means nearly instant access to funds via a safe and secure online transaction.

- Your credit score does not affect your eligibility for e-transfer personal loans in Ontario. We understand that everyone’s financial situation is different, which is why we don’t check credit scores or credit reports during our online application process.

- Applying has never been easier. Just submit a quick online application and receive an immediate response.

- Our safe and secure system protects your data and ensures the integrity of every transaction. You may rest assured that your information is safe with us.

- E-transfer personal loans offer longer repayment periods. Therefore, these types of personal loans can tide you over for longer periods than payday loans would. This can help you avoid the payday loan cycle.

Are E-Transfer Personal Loans Better Than E-Transfer Payday Loans?

E-transfer personal loans have several potential advantages over e-transfer payday loans, as follows:

- E-transfer personal loans offer a longer repayment period. That means you have more time to repay your loan over a series of regular installments, instead of paying everything at once by the next payday.

- E-transfer personal loans can help you avoid a payday loan cycle. If you know that you’re going to need multiple payday loans over the short to medium term, it may serve you better to apply for an e-transfer personal loan instead. An e-transfer personal loan will provide you with funds to tide you over a longer period than a payday loan would. This, in turn, may help you avoid the payday loan cycle.

- You don’t have to pay the full amount by your next payday. The installments are spaced out over a longer period, allowing you to pay back the loan at a more measured pace, instead of paying the full amount on your next payday. This may be easier on your wallet.

Apply for Online E-Transfer Personal Loans in Ontario Now

As described above, online e-transfer personal loans offer several potential benefits and advantages over online e-transfer payday loans. If you need to cover emergency expenses or even simple everyday expenses, consider applying online via Crediteck.

Submit a quick online application via Crediteck and receive an immediate response. We don’t check your credit score or credit report during our online application process, so it’s never been easier to qualify for online e-transfer personal loans, even with a poor credit history! You may get funds deposited directly into your bank account in as little as 24 hours.

You Can Obtain E-Transfer Personal Loans Across Canada

You can apply for e-transfer personal loans anywhere in Ontario, including the following cities: Toronto, Oakville, Hamilton, London, Kitchener, Niagara Falls, Oshawa, Ajax, Markham, Bowmanville, Cambridge, Brantford, Vaughn, Barrie, Newmarket, Kingston, Owen Sound, Sudbury, Thunder Bay, Brampton, Mississauga, Richmond Hill, Ottawa, and more. You can also obtain online e-transfer personal loans in Alberta, Saskatchewan, British Columbia, Nova Scotia, New Brunswick, and other places throughout Canada.