Alberta is one of the thirteen provinces and territories of Canada. It is the fourth largest province by area and, with over four million residents, the fourth most populous. Alberta’s overall cost of living, including housing, entertainment, and taxes, is one of the lowest in Canada.

However, the living wage varies across Alberta, from as low as $23.70 per hour in Calgary to as high as $32.75 per hour in Canmore, in stark contrast to the minimum wage of just $15.00 per hour. There exists a large gap between the living wage and the minimum wage across this province.

The rising cost of food, gas, and electricity concerns many Canadians, with over 60 percent of Albertans saying they’re falling behind the cost of living, according to one survey. If you find yourself struggling with the cost of things in Alberta, you are not alone!

How Can a Personal Loan Help in Alberta?

You can use a personal loan to help you cover almost any expense. The money will be deposited directly into your bank account. Whether you need to cover rent, utilities, car repairs, education, a vacation, or almost anything else, a personal loan can help you do that.

Just make sure that you can afford the monthly payments. A personal loan could provide quick short-term financial relief for you and your family.

Rules and Regulations for Personal Loans in Alberta

Alberta has many rules and regulations in place for online lenders in order to help protect the consumer. The regulations for online lenders in Alberta include the following:

- Must have a business license

- Must provide key loan information

- Must disclose information about optional related products if applicable

- Must provide written or electronic confirmation that optional products have been cancelled if applicable

- Must provide the borrower with information about the loan details during the term of the loan

Prohibited business practices include the following:

- Must not mislead borrowers in loan advertisements, solicitations, or negotiations

- Must not call borrowers before 7 A.M. or after 10 P.M. local time

- Must not contact third parties in relation to a borrower’s debt

These regulations came into effect January 1, 2019.

Do You Need a High Credit Score to Get a Personal Loan in Alberta?

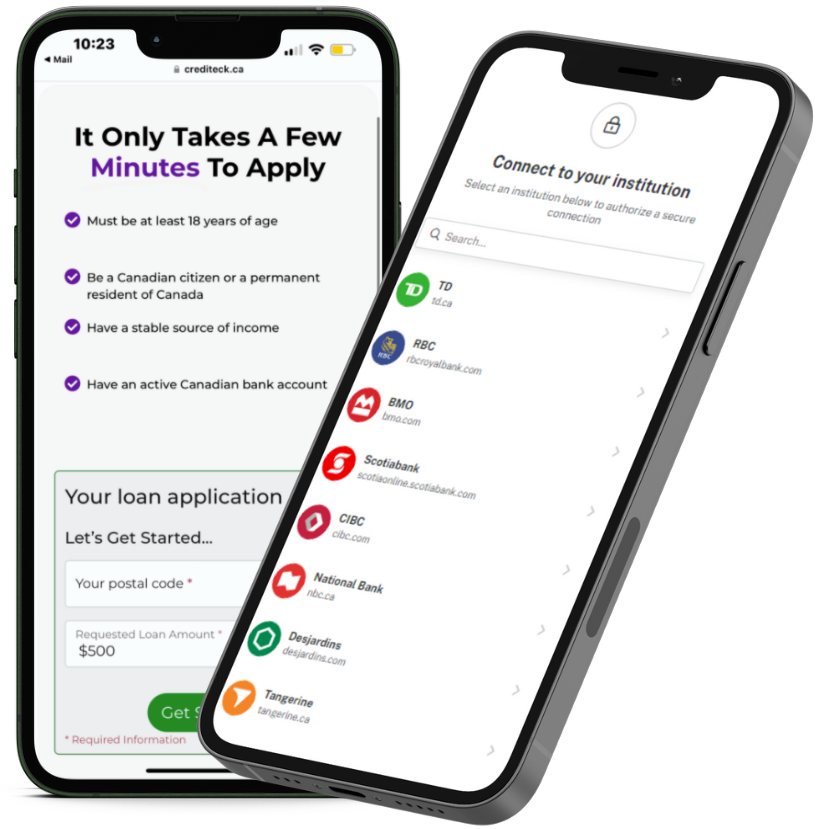

While banks look closely at your credit score and credit report, some online lenders may not check your credit score or credit report at all. Here at Crediteck, we do not check your credit score as part of our online application process. Even if your score is less than perfect, you still have a good chance of getting approved for a loan with one of our online installment lenders. Apply now. It only takes a few minutes!

That being said, it can be useful to know where you stand credit-wise. If you wish to check your credit score and other personal financial information, consider registering with Credit Verify! Click here to learn more.

Requirements for Getting a Personal Loan in Alberta

Common requirements include proof of income, a permanent address, and a bank account. The applicant must be a Canadian citizen or permanent resident. Aside from these basic requirements, even with bad credit, it’s possible to get a personal loan in Alberta.

Instant Bank Verification (IBV) for Personal Loans in Alberta

Instant Bank Verification (IBV) is a nearly instant check used by online lenders to confirm the bank account you provided belongs to you and confirm the application details you provided.

Tips for Getting Approved for a Personal Loan in Alberta

While it is possible to get approved for a personal loan with an imperfect credit score and other factors, you may improve your odds of getting approved by several methods.

- Have a stable source of income

- Have few or no NSF transactions

- Have a low short-term debt ratio – a minimal number of active short-term or payday loans

- Have an active Canadian bank account – it should have been active for at least 90 days

Pros of Getting a Personal Loan

What are some of the pros of getting a personal loan in Alberta? Consider the following:

- Immediate financial relief

- Ability to cover an unexpected expense or even normal everyday expenses

- Predictable repayment schedule

Cons of Getting a Personal Loan

Consider the following cons as well:

- The fees and interest will accumulate if you are unable to make your payments

- NSF and other fees may be charged on top of your loan

What Sources of Income Are Acceptable for Getting a Personal Loan in Alberta?

Many different sources of income may be acceptable if you wish to obtain a personal loan in Alberta, including the following:

- Employment income

- Self-employment income

- Government benefits

How Can I Increase My Income in Alberta?

Given modern cutting-edge technologies, information has never been more accessible! It is easier than ever to learn new skills, earn new certifications, attend bootcamps, and so on, all without leaving the comfort of your home and sometimes without paying a cent! From coding to graphic design, professional writing to data science, you can learn many useful, paying skills with the help of online resources.

The more skilled you are and the better able you are to demonstrate your skills, the more employable you will become. Higher employability combined with a well-crafted resume can help you get hired and earn more money. This will enable you to cover your everyday living expenses with far less trouble than before.

FAQ

Can I get a personal loan with bad credit in Alberta?

Some private online lenders do not check your credit score or credit report. Apply online with Crediteck – we do not perform credit checks as part of our online application process! You will be connected with our network of online installment lenders in a flash.

Is it better to get a payday loan or a personal loan?

A payday loan is a short-term, high-interest loan. You are likely going to take out multiple payday loans, which can trap you in a debt-repayment cycle. A personal loan is a single loan that you can repay over a longer period of time at a relatively lower interest rate, so you can avoid getting stuck in a payday loan cycle.

How do I apply for a personal loan in Alberta?

The process is easy. You can simply submit a quick online application. Click here to apply with Crediteck. The application process only takes a few minutes, and you will get an immediate response.