The Cost of Living in New Brunswick

New Brunswick is among the smallest and least populous provinces in Canada, containing just over 2% of Canada’s population. It is also the least expensive province in Canada, comparatively speaking. That doesn’t mean that life is easy for people in New Brunswick.

As of 2023, the living wage was estimated at $24.50 per hour in Fredericton, $23.35 per hour in Saint John’s, $22.75 per hour in Moncton, and $21.65 per hour in Bathurst. New Brunswick’s new minimum wage is just $15.30 per hour, which is $9.30 per hour short of the living wage in Fredericton, $8.15 per hour short of the living wage in Saint John’s, and so on down the list. The provincial minimum wage is not sufficient to afford a comfortable lifestyle anywhere in the province.

A report for 2024 has found that the overall food prices in New Brunswick were predicted to rise by 2.5% to 4.5%. The cost of gasoline has risen throughout the country, along with the cost of most necessities. Many residents are feeling the pinch.

How Can a Personal Loan Help in New Brunswick?

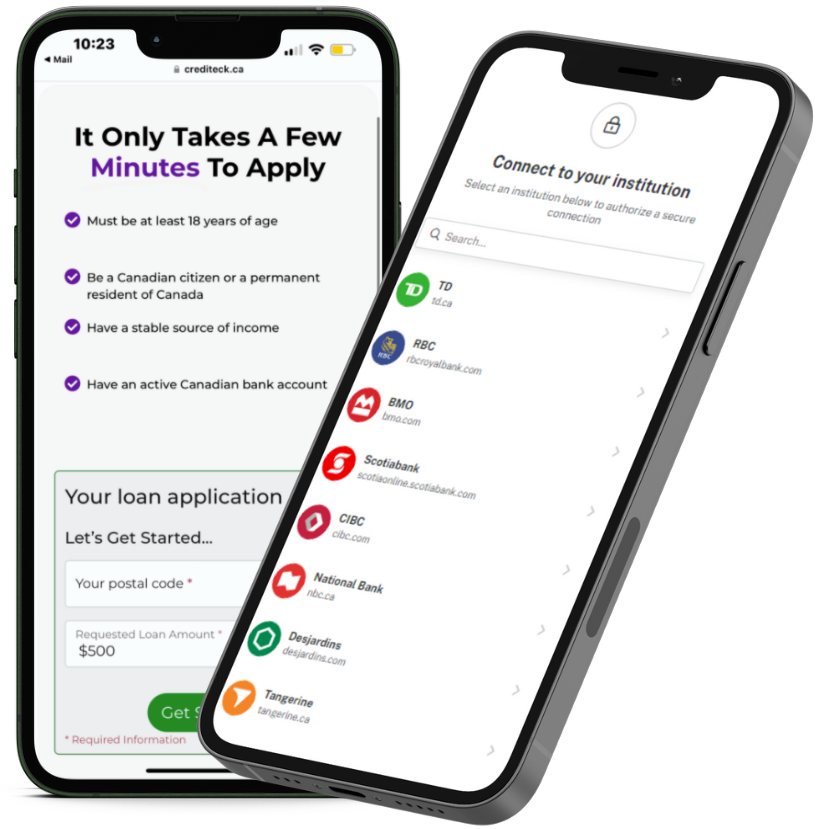

Given the exorbitant cost of living, you may sometimes find yourself without cash in between paydays. In order to cover the necessary expenses, you may wish to take out a personal loan via Crediteck. We will connect you with online installment lenders across New Brunswick. Rather than simply getting you to your next payday with the use of payday loans, a personal loan offers a longer repayment term, giving you more flexibility.

Requirements to Get a Personal Loan in New Brunswick

In New Brunswick, the most common requirements by online lenders include the following:

- You must be 18 years of age or older

- You must be a Canadian citizen or permanent resident

- You must have a permanent address

- You must provide proof of consistent income

- You must have a Canadian bank account that has been active for at least 90 days

Tips to Help You Get Approved for Personal Loans in New Brunswick

- Minimize NSF transactions

- Maintain the lowest possible number of active and ongoing payday loans or short-term loans

Instant Bank Verification (IBV) for Personal Loans in New Brunswick

Online lenders in New Brunswick may use Instant Bank Verification (IBV) to confirm your banking and application details so that the funds can reach the intended person and your eligibility can be assessed correctly.

Accepted Sources of Income

- Employment income

- Self-employment income

- Government benefits

Pros of a Personal Loan in New Brunswick

- Access immediate financial assistance

- Cover urgent expenses

- Follow a predictable repayment schedule

Cons of a Personal Loan in New Brunswick

- You may be charged NSF fees

- If you’re late with your payments, interest may accrue

Improve Your Financial Health in New Brunswick

During these trying times, you may wish to improve your financial health by a variety of means:

- Upgrade your professional skills. Nowadays, you can take an online course to learn almost any skill, whether it’s coding or graphic design, cybersecurity or advertising copywriting, and many more. Many of these courses offer certificates as well, which you can add to your Linked-In profile. Online tools are also helpful in building a professional website or portfolio. Take advantage of these resources to level up your career.

- Follow a budget. Decide how much of your monthly income you’re going to allocate to different spending categories, including needs, wants, and saving/paying off debt. Following a budget is going to set you up for better financial health down the road as long as you remain consistent.

- Consider debt consolidation. This may help you concentrate on a single monthly payment instead of worrying about multiple different creditors. You may also get the benefit of a lower interest rate.

- Set goals. If you don’t set any goals, you’re unlikely to reach them. Decide on your savings and debt repayment goals, your income goals, your professional goals, and so on. Leave nothing up to chance and write your goals down in a Word document or spreadsheet. Refer to your goals consistently and track your progress.

Bonus Tip

Monitor your credit score. A good credit score can help you with a rental application, a mortgage approval, and many other financial transactions. To access your credit report, register with Credit Verify. Registration takes only a few minutes, giving you access to a wealth of information and benefits.

Need a Bad Credit Personal Loan in New Brunswick?

Are you looking for a personal loan to help cover emergency expenses? Apply online with Crediteck! We will instantly connect you with online lenders across New Brunswick. Fill out a quick online application and get an immediate response.