Intro: The Cost of Living in Saskatchewan

Saskatchewan is the sixth most populous province in Canada, boasting over one million residents. It is relatively more affordable than many other Canadian provinces and territories. However, Saskatchewan’s minimum wage sits at just $15.00 per hour effective October 1, 2024, while the living wage in the regional capital, Regina, is estimated at $16.45 per hour. The discrepancy between the living wage and the minimum page persists across all regions of Canada, and Saskatchewan is no exception. Given the rising cost of groceries, gas, and housing, many lose sleep over their ability to pay their bills, save for retirement, or save for a large purchase or expense.

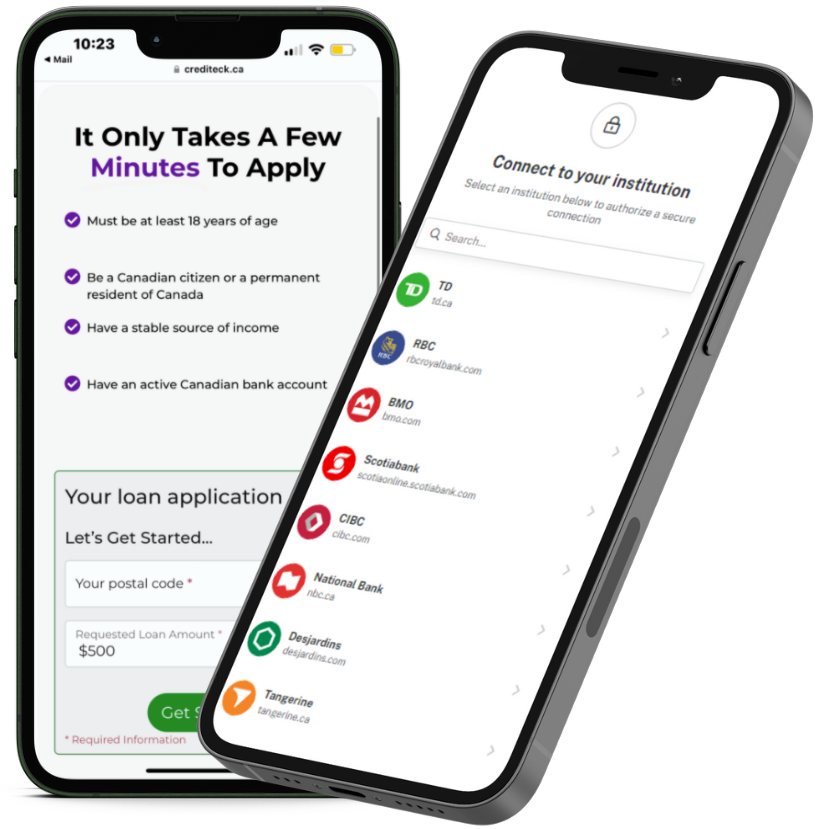

How Can a Personal Loan Help in Saskatchewan?

When you need to close a gap in cashflow or get through to the next paycheck, a personal loan in Saskatchewan can help you meet that need. Help cover your urgent expenses with Crediteck. We do not perform credit checks during our online application process. Even with poor credit, you can get a personal loan in Saskatchewan.

Requirements to Get a Personal Loan in Saskatchewan

You need to provide proof of stable income, a valid bank account, and a permanent address. You must also be a Canadian citizen or permanent resident. Bad credit is not an obstacle to getting a personal loan in Saskatchewan.

If you need to check your credit score or credit report, try Credit Verify. Registration takes only a few minutes, and you get access to a wealth of personal financial information and benefits.

Instant Bank Verification (IBV) for Personal Loans in Saskatchewan

Instant Bank Verification (IBV) is a nearly instant check used by lenders in Canada to confirm your application details and bank account and to determine your eligibility for a personal loan.

Get Approved for a Personal Loan in Saskatchewan!

- Minimize NSF transactions

- Minimize number of active payday loans or short-term loans

- Must have an active Canadian bank account that has been active for at least 90 days

- Maintain consistent income

Pros of a Personal Loan

These include the following:

- Immediate financial relief

- Ability to cover an unexpected expense or even normal everyday expenses

- Predictable repayment schedule

Cons of a Personal Loan

- The fees and interest will accumulate if you are unable to make your payments

- You may be charged NSF and other fees

Sources of Income to Get a Personal Loan in Saskatchewan

- Employment income

- Self-employment income

- Financial government assistance

Improve Your Finances in Saskatchewan

Even in tough economic times, there are ways to improve your finances.

First, it’s never been easier to learn new skills online. You could learn computer programming, graphic design, marketing, and other professional skills by taking online courses and bootcamps or watching tutorials and reading up on helpful materials online.

Second, following a budget and living below your means would help you regain some financial stability. Whatever budget style you pick, make sure that you allocate some income each month to saving and repaying your debts, if possible.

Get a Bad Credit Personal Loan in Saskatchewan

Crediteck is here to help. Simply fill out a quick online application and get connected with our online installment lenders across Canada. No credit check required! The process is fast and easy, and you will get an immediate response. Apply online now.