According to the president of Equifax Canada, about 50% of Canadians are living paycheque to paycheque. Amid a challenging housing market and a high cost of living, many Canadians struggle to keep up with their expenses. Younger Canadians – those under 35 years of age – are among the hardest hit with over half of that group falling into the paycheque-to-paycheque category.

If you’re among the millions of Canadians who are in that situation, you may be asking yourself, “How do I stop living paycheque to paycheque?” We have seven tips for how you can achieve that worthwhile goal.

1. Come up with a budget

Let’s start with the basics: a budget. Write down your total monthly income and subtract the necessary expenses, such as the following:

- Rent/mortgage payment

- Utilities

- Groceries

- Transportation

You will then be able to figure out how much room you have for discretionary spending. Consider shrinking the amount of money you spend on things that you can do without. Avoid impulsive or emotional buying and focus on putting your money to work.

2. Start saving

Ideally, you would be able to take at least $100-200 from every paycheque and put it into a savings account. If you’re unable to do that, you might have to do one or both of the following:

- Increase your income

- Reduce your spending

At the end of the day, cashflow is a math equation. If you’ve ever dieted, you’ll know that it’s all about calories consumed and calories burned. Financial health is similar: managing your cashflow requires discipline and commitment to a better outcome.

3. Increase your income

While precarious and low-paying jobs are widespread, there are opportunities to increase your income in today’s challenging economy. You might consider a few different options.

First, you could start a side hustle. Perhaps you have a hobby that you can monetize, such as crocheting or woodworking. Monetizing unusual interests or niche hobbies is easier than ever in the age of social media. Perhaps you can sell your art online or take on a part-time job or weekend gig to supplement your main income.

Second, you might consider learning new skills online or attending school part-time. Retraining for a new career may seem daunting, but in the Internet age, there are nearly infinite opportunities to learn new skills, often for a low fee or even for free! You can watch online tutorials, take online courses, attend bootcamps, and generally propel your skills upward.

4. Stop taking on more debt

If you’re on a ship and it’s leaking, the first thing you want to do is stop the leak. Taking on unnecessary debt is not going to help you achieve better financial health. It’s one thing to cover emergency expenses and quite another to overspend on an exotic vacation or a fancy purchase. You don’t want to add to your existing debt levels if you can help it.

5. Pay off your debt

Your debt is holding you back. There are two main methods people use to pay off debt: the snowball method and the avalanche method. Choose one to help you resolve this situation.

The Snowball Method

The snowball method involves paying off your smallest debt first, followed by the second-smallest, and so on, until you’re done. Similarly to a snowball rolling down a hill, the size of the debts you tackle increases with every step.

The Avalanche Method

The avalanche method means paying off the loan with the highest interest rate first. Once you pay off the highest-interest loan, you will shift your focus to the loan with the next highest interest rate and so on, until your debts are paid off.

Whichever method you choose, make sure you stick with it until you see the desired results.

6. Consider debt consolidation

If you’re dealing with multiple different debts, you may wish to consider debt consolidation. It works by combining all your debts into one loan. Debt consolidation will allow you to pay a single monthly payment, possibly at a lower interest rate. This may help reduce your stress and make life easier.

7. Cut down on non-essential purchases

If you’re unable to save any money, it could be that you’re spending too much on non-essential items. You might be buying new clothes too often or buying new technology too often. Consider cutting down on frivolous expenditures. This will help you manage your cashflow more efficiently.

Conclusion

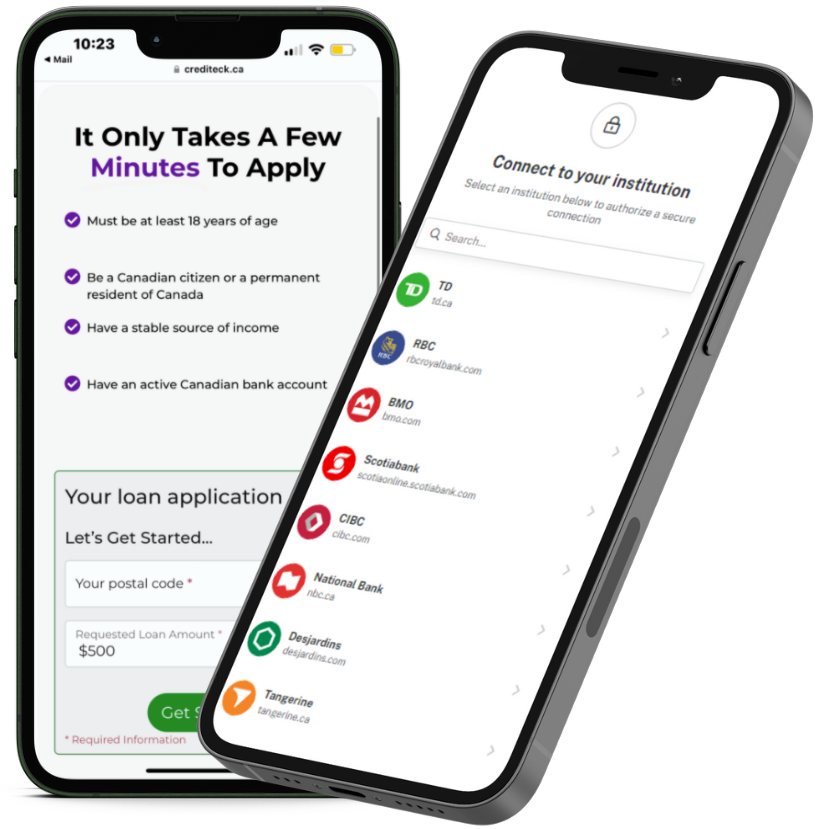

While the path ahead may seem difficult and uncertain, there are proactive steps you can take to help remedy your situation. If you follow the above seven tips, you should be well on your way to a financially healthier life. We’re happy to support you during this journey. If you face unexpected expenses that you cannot cover, apply for a loan online with Crediteck. We don’t check your credit score or credit report during our simple online application process.