Personal loans and credit cards represent two different types of credit. In this article, we will explore their key characteristics and differences as well as the pros and cons of each.

Personal Loans: Key Characteristics

- A fixed amount of money borrowed. Personal loans are not a revolving credit, although you may, of course, take out multiple personal loans over a given period.

- Repaid in installments. Instead of repaying everything on the next payday as you would with a payday loan, you can repay a personal loan in several installments. This gives you more flexibility in making the payments.

- Interest and fees may apply. Based on your application details and the lender you work with, you may have to pay a specific interest rate and fees.

Credit Cards: Key Characteristics

- Credit cards represent a revolving type of credit. This means you can repeatedly borrow a pre-approved amount as long as your account remains in good standing with the bank.

- Repaid on a monthly basis. Every month, you are presented with a balance to be repaid by a certain due date. If you fail to pay the minimum amount, you may be charged additional fees and penalties. If you only make the minimum payment on a regular basis, you may end up paying higher interest and fees in the long run.

- Credit utilization ratio. If you maintain a low credit utilization ratio, that is, the amount you spend versus the total amount available to spend on a revolving basis, you can build a better credit score. Ideally, your credit utilization ratio would not exceed 30% at any given time.

- Credit card activity is reported to credit bureaus, which will affect the user’s credit score. If you fail to make your payments on time, it will negatively impact your credit score. This may affect your ability to borrow money or access various financial services in the future.

Personal Loans vs. Credit Cards: Key Differences

- While personal loans offer a fixed amount of money and an agreed payment schedule, credit cards are usually meant to cover recurring expenses i.e. represent a revolving type of credit.

- While credit card activity is always reported to credit bureaus, thus affecting your credit score, applying for personal loans may not affect your credit score. This will depend on the lender. However, if you miss payments or are late making payments, that could affect your credit score.

- Personal loans may benefit those who do not have access to traditional financial services, while credit cards can help those with access to traditional financial services to build a better credit standing.

Personal Loans: Pros

- You can cover urgent expenses quickly. This may help bridge the gap in your cashflow.

- Fast access to funds. You can get funds as soon as the next day.

- Longer repayment period. This gives you more time and flexibility in repaying the loan.

- No credit checks. Even with a less-than-perfect credit history, you may qualify for personal loans.

- Applying may not affect your credit score. This is dependent on the lender.

- Your personal financial information remains secure thanks to encryption technology.

- Personal loans with online lenders provide an alternative to underbanked and underserved customers who may not have access to more traditional financial services.

Personal Loans: Cons

- If you are unable to make your payments, you may be charged additional interest and fees.

- If you don’t have sufficient funds to cover a transaction, you may be charged NSF fees.

Credit Cards: Pros

- You are able to cover recurring expenses using the revolving structure of the credit.

- If you pay your balance in full every month, you can build good credit, which is very useful when you apply for a rental or mortgage.

- Maintaining a low credit utilization ratio will also positively impact your credit score.

Credit Cards: Cons

- If you do not pay the balance in full by the end of each month, you may be charged additional interest.

- There are many potential fees associated with credit cards, including annual fees, late payment fees, balance transfer fees, cash advance fees, and foreign transaction fees.

- If you stay close to or exceed your credit utilization limit, it will negatively affect your credit score.

- If you have a low credit score, you may not qualify for a credit card. If you need to improve your credit score, sign up with Credit Verify! The registration process takes only a few minutes, and you will be able to track your credit score and catch any mistakes on your credit report.

Conclusion

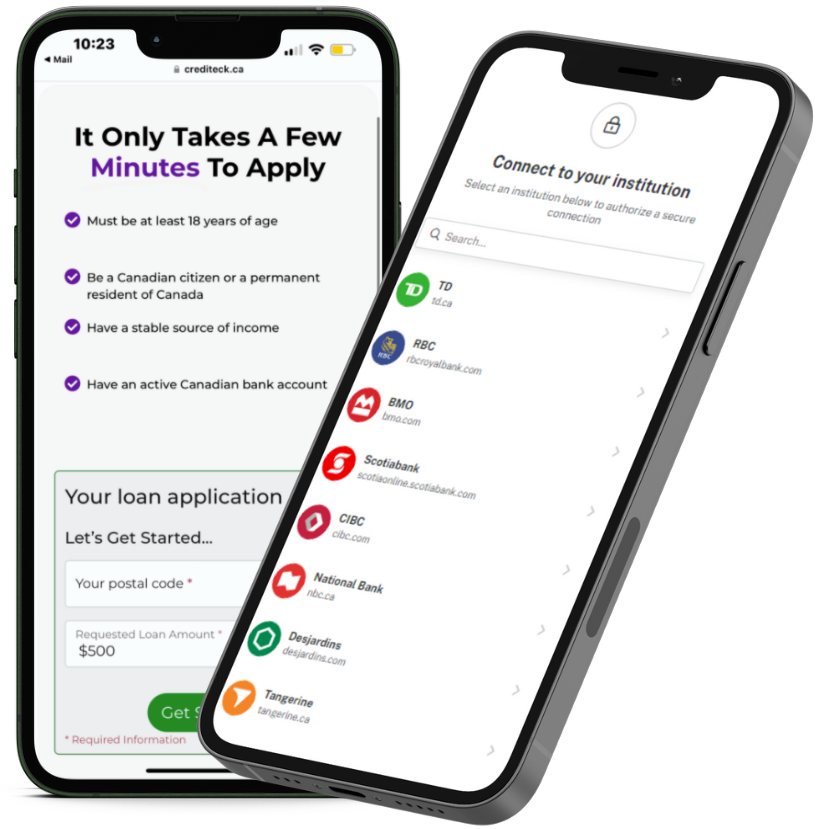

Personal loans and credit cards are two distinct types of credit that serve differential needs in the market. Personal loans are usually meant to cover immediate financial needs, while credit cards are meant for recurring, everyday expenses. Those who do not have access to traditional financial services, including, potentially, credit cards, may benefit from personal loans with online lenders. Each type of credit has unique pros and cons. If you need a personal loan to cover urgent expenses, consider applying online via Crediteck. You will get an immediate response, and we don’t check your credit score during our simple and quick online application process!