Intro

Online loans and traditional loans are very different. Each has its own pros and cons, depending on your unique situation and preferences. While online loans generally offer convenience and speed, traditional loans involve in-person meetings.

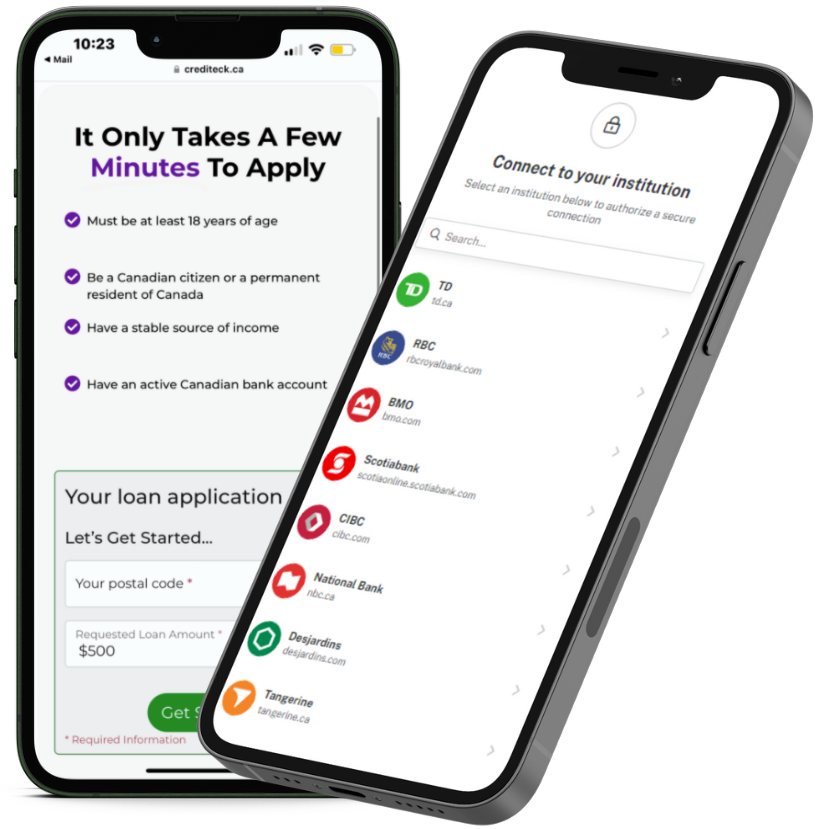

Need a loan? Apply online to connect with our online installment lenders in Canada. We do not perform credit checks as part of our application process.

Online Loans

Online loans have many advantages over traditional loans. Given today’s rapid rise of modern banking and financial technologies, it’s no wonder that more people are opting for online loans.

Here are some pros and cons of online loans:

Pros

- No credit checks in some cases

- Faster approval process

- Faster application process

- No in-person meetings

Cons

- Beware of online scammers

- Make sure the lender offers secure online transactions

People who have bad credit may wish to apply for online loans. Traditional lenders will look at your credit report and credit history, which can be a major drawback for those of us with less-than-ideal credit scores. Apply now. Crediteck will connect you with online installment lenders in a flash.

Traditional Loans

Applying for a traditional loan can be a lengthy process involving in-person appointments with a representative from the bank or another financial institution. Traditional lenders will look closely at your credit score and credit report. The approval process takes longer than it does for online loans.

Pros

- If you prefer to have an interpersonal element, a traditional loan could be for you

- If you have a history of keeping your money at a particular bank, it may be easier to obtain a loan there

Cons

- Traditional lenders will look closely at your credit score and credit report

- Need to attend an in-person meeting

- Slower application process

- Slower approval process

If you have some larger expenses coming up – such as a home renovation or kitchen remodelling – you may wish to check out Equity Recharge, a reliable provider of home equity lines of credit (HELOCs)!

In Summary

Online loans and traditional loans each have their pros and cons. Perhaps the biggest difference is that online lenders do not look as closely at your credit history and do not require in-person appointments.

Crediteck can connect you with a network of online lenders across Canada. Just submit a quick online application here and set yourself on a better financial path.