Overview of Personal Loans

At their core, personal loans are a specific amount of money that you borrow and pay back over a certain period. Personal loans are also known as installment loans or consumer loans. You must pay a personal loan back in full, including interest and applicable fees. The payments are made in a series of regular installments.

Personal loans may be used to cover a wide variety of expenses, including major renovations, vehicles, car repairs, medical expenses, furniture, and more.

You may obtain personal loans at traditional financial institutions like banks and credit unions, or you may use online lenders. The advantage of online lenders over more traditional banks is that online lenders may not check your credit score or credit report. That means it will be easier to qualify for loans, particularly if you have a suboptimal credit score. Meanwhile, banks will typically look closely at your credit score and credit report and reject your application if you fall below a certain threshold. That’s why online lenders tend to serve underserved customers and fill an unmet need in the market.

While online lenders allow customers with less-than-perfect credit scores to access funds quickly, it’s important to monitor your credit score. Credit Verify allows you to track your credit score so that you can improve your credit health.

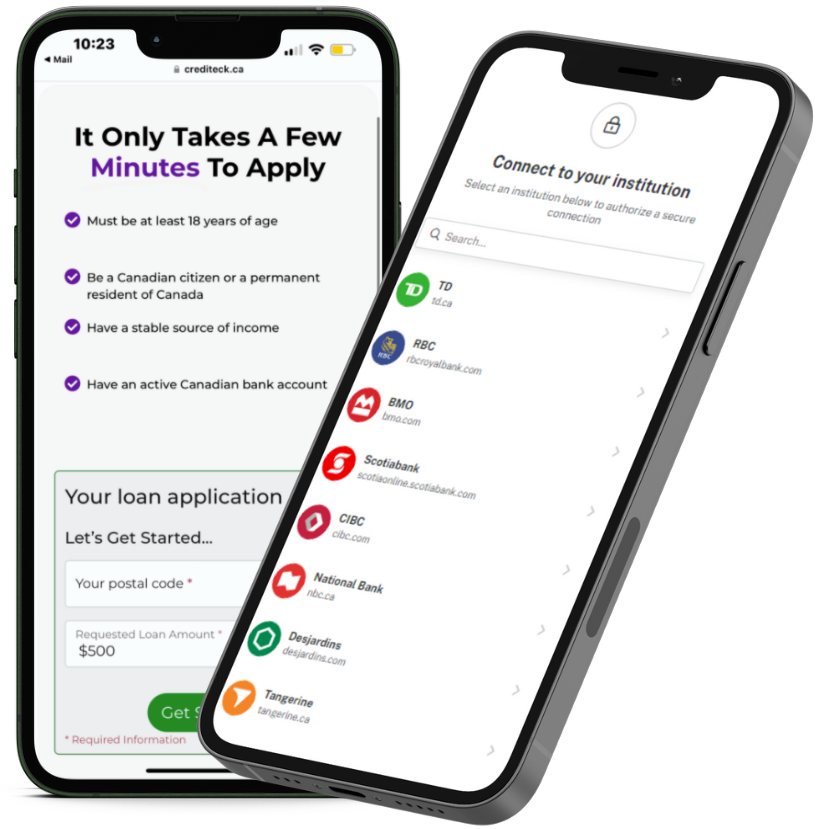

Typically, to qualify for online personal loans in Canada, you need to meet some basic criteria:

- You must be at least 18 years of age.

- You must be a Canadian citizen or permanent resident.

- You must have a permanent address.

- You must provide proof of a consistent income.

- You must have a valid Canadian bank account that has been active for at least 90 days.

Factors that may negatively impact your chances of getting approved include NSF transactions and a high number of active payday loans or short-term loans.

Typically, in the case of an online lender, you will get your funds deposited directly into your bank account. The funds may be deposited as soon as the next day.

It is important to understand the terms and conditions of your loan. Consider aspects like the amount that you borrow, the interest rate, applicable fees, and repayment schedule. Make sure you can afford the loan before you take it out. The costs associated with personal loans include the amount that you borrow, interest, and any applicable fees.

In terms of repaying your loan, many lenders will ask for your banking information so that they can set up pre-authorized debit to receive payments directly from your account. You may be able to make extra payments to pay off your personal loan more quickly. Reach out to your lender for more information.

If you have any questions or complaints regarding your personal loan, contact your lender right away. If your lender isn’t federally regulated, you may contact the regulator in your province or territory.

Types of Personal Loans

There are many different types of personal loans. Different types of personal loans are best suited for different needs. For example, a debt consolidation loan is most helpful to those dealing with multiple creditors and high-interest debt, while a personal line of credit is best for those who need flexible access to funds for a major renovation or an ongoing emergency. Discover the different types of personal loans and which ones may be right for you.

Unsecured Personal Loans

An unsecured personal loan is simply a type of personal loan that doesn’t require collateral. If you’re unable to make payments on this type of loan, you won’t lose your asset i.e. collateral. However, you may face higher fees and interest. While banks may look at your credit score before giving out an unsecured personal loan, many online lenders are willing to take on customers with low credit scores.

Secured Personal Loans

A secured personal loan does require collateral. If you default on your payments, you risk losing an asset i.e. your collateral. The benefit of a secured personal loan as opposed to an unsecured personal loan is that the lender may be willing to offer a lower interest rate, due to the fact that they’re taking on a bit less risk than they would with an unsecured personal loan.

Debt Consolidation Loans

A debt consolidation loan is just what it sounds like, allowing you to combine multiple debts into a single monthly payment, likely at a lower interest rate. The benefit of this type of loan is that you may pay it off faster, save on interest, and not have to worry about multiple different creditors.

Co-Signed Loans

For those who are unable to secure a loan on their own, a co-signed or joint loan may allow them to access a loan when a co-signer with higher creditworthiness agrees to share responsibility for the loan. The risk of this type of loan is that both co-signers will see an impact on their credit scores, if they miss any payments.

Fixed-Rate Loans

Most personal loans are fixed-rate loans, which means that the interest rate doesn’t change throughout the repayment period. This makes it easier to budget and plan for repaying the loan.

Variable-Rate Loans

The interest rate may vary based on fluctuating market conditions. You may be able to get a lower interest rate on a variable-rate loan than on a fixed-rate loan, but you also run the risk of a higher APR. In this case, it’s best to take out a shorter-term loan so that you can repay it more quickly and not worry about a sudden increase in the interest rate.

Personal Lines of Credit

A personal line of credit is like a credit card, allowing you to borrow repeatedly and pay interest only on the amount that you borrow. This type of credit is best for those who are dealing with a large or ongoing expense, such as a home renovation. Personal lines of credit are typically secured by financial assets, but you may obtain unsecured options with online lenders.

Buy Now, Pay Later Loans

These types of loans allow you to make a purchase without paying the full price upfront. The remaining balance will be divided into installments, which you typically pay back within six weeks of the original purchase. These loans are typically offered through mobile apps and do not require a high credit score.

Credit Card Cash Advances

You may be able to take a cash advance from your available credit at an ATM or a bank, but you’ll be charged a cash advance fee and a higher interest rate on the amount that you borrowed.

Cash Advance Apps

These apps allow you to borrow cash fast, until payday. The apps typically charge a monthly fee and require you to pay back the amount on your next payday.

Payday Loans

These loans allow customers with low credit scores to borrow money until the next payday, but they typically come with higher fees and interest rates.

Pawnshop Loans

Pawnshops allow you to exchange your asset for cash, but you will be charged high interest and may lose your asset if you default on your payments.

Title Loans

A car title loan allows you to borrow money against the value of your car, but you risk high fees or even losing your car if you default.

Steps to Apply for a Personal Loan

If you need an unsecured, fixed-rate personal loan, apply online via Crediteck. Applying for personal loans online has never been easier. Follow these simple steps:

- Fill out our quick online application.

- Get approved.

- Get your funds deposited directly into your bank account!

Get Your Personal Loan in Canada Now

You can get personal loans anywhere in Ontario! We’re excited to connect you with online lenders in Toronto, Hamilton, Oakville, Guelph, London, Oshawa, Windsor, Markham, Ottawa, and more. You can also get personal loans in Alberta, Saskatchewan, Nova Scotia, New Brunswick, and most other Canadian provinces. Apply online via Crediteck. The application process takes only a few minutes, and you will receive an immediate response.