Overview

Loan applications may get rejected for a variety of reasons. Typically, lenders use various means to evaluate applicants’ ability to afford their loans. These means may include both automated systems and human analysts. If a lender decides that you may be unable or unwilling to repay your loan, they may reject your application. Here are some common reasons why lenders may decide not to fund your loan.

Reason #1: You Do Not Meet the Basic Requirements

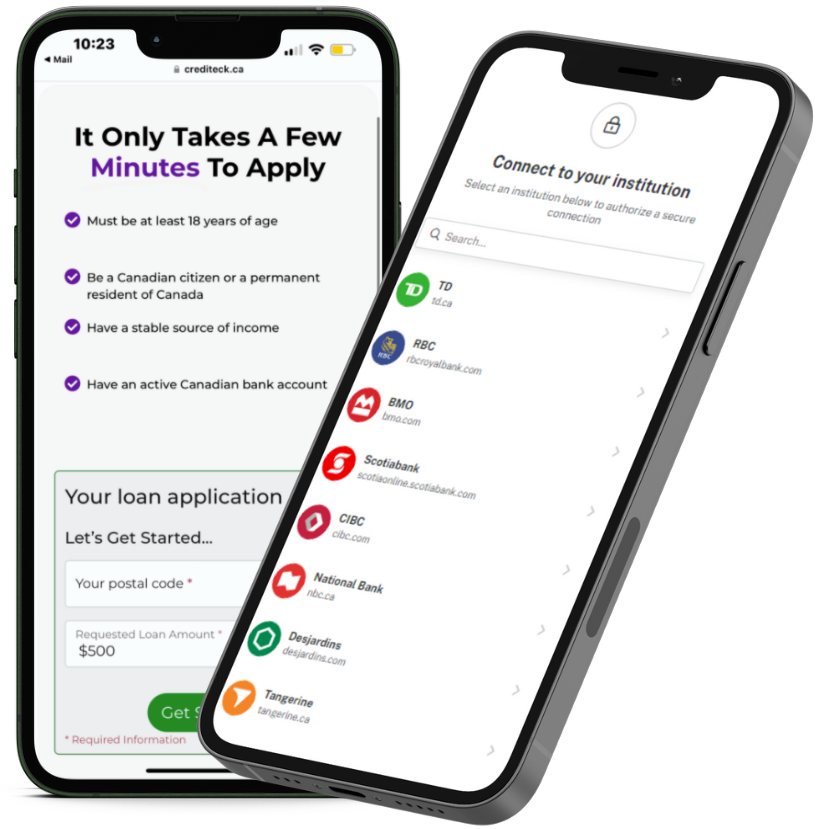

All lenders have certain requirements. Typically, these requirements include the following:

- You must be at least 18 years of age.

- You must be a Canadian citizen or permanent resident.

- You must have a permanent address.

- You must have a valid Canadian bank account, which has been active for at least 90 days.

These requirements filter out applicants whom lenders consider a high credit risk or simply not their target customer. If you do not meet the lender’s minimum requirements, it’s best to look for alternative borrowing options.

Reason #2: You Lack a Consistent Income

Having a reliable income is perhaps the number one indicator of your ability to afford any loan with any lender. In the absence of a stable income, your ability to repay a loan may be severely limited. Therefore, you may present too much of a risk to most lenders. Before you apply online, make sure you meet the income requirement. Some lenders may require proof of your income. The lenders we work with use sophisticated encryption technology to safeguard any personal data you provide.

Reason #3: You Have an Extensive History of NSF Transactions

Non-sufficient funds (NSF) transactions occur when a bank account does not have sufficient funds to cover a transaction that has been attempted. Frequent NSF transactions indicate that you are frequently unable to meet your financial obligations. This general lack of financial stability and reliability may be deemed an excessive risk by many lenders. Therefore, make sure you minimize your NSF transactions before applying for a loan. Better yet, avoid NSF transactions altogether! For more information on NSF transactions and the associated fees as well as tips on avoiding them, refer to this article by CIBC.

Reason #4: You Have Very High Debt Levels

When your debt obligations are exceedingly high relative to your income, taking on an additional loan may not help the situation. With so many debts to repay, you may be unable to afford another loan and therefore may not be a suitable candidate for a given lender. This is just another way of assessing your ability to afford and/or repay your loan, which is likely to be compromised by an excessive debt load. Refer to the article “Debt-to-Income Ratio (DTI): What It Is and Why It Matters” for additional information on a closely related topic.

Reason #5: You Have Too Many Ongoing/Active Payday Loans/Short-Term Loans

Similarly to reason #4, having too many ongoing/active payday loans and short-term loans indicates to lenders that you may already be overextended in terms of your financial obligations and therefore unable to take on any additional loans. Before you apply, make sure to minimize your number of active/ongoing payday loans and short-term loans for your best chances of approval.

How to Avoid Getting Rejected

Keep in mind a few simple tips to avoid having a loan application rejected:

- Adhere to the lender’s strict requirements, such as their income requirement, minimum age requirement, and so on. Failing to meet these basic requirements is likely to result in your loan application not getting approved.

- Make sure you have few or no NSF transactions or ongoing/active payday loans and short-term loans. This will help ensure that you have more financial capability in repaying any loans you take out.

- Provide full and accurate information on your loan application. Inaccurate or incomplete information is unlikely to result in a loan approval.

The Bottom Line

While there exist several different reasons as to why lenders may reject a loan application, all of these reasons usually have to do with your likely ability or inability to repay your loan. Lenders must evaluate the risk levels of prospective borrowers based on clear predetermined criteria, which are applicable to all applicants to an equal extent. Otherwise, lenders risk giving money to unreliable borrowers or borrowers who cannot pay their loans back.

If you need a personal loan to cover immediate expenses, apply online via Crediteck. We don’t check your credit score or credit report during our quick and simple online application process. It’s never been easier to apply or qualify! Keep in mind the above common reasons why loan applications may not get approved and adhere to the lender’s requirements for your best chance of approval.