Personal Loans For Bad Credit From $100 - $5,000

Through our platform you can access fast personal loans for bad credit when you need emergency financial relief. We connect your application with our network of Canadian lenders, who often don’t perform credit checks and judge your application based on your income and other factors.

- * No Credit Checks

- Get Up To $5,000

- Fast Approvals

- Direct Deposit

What Are Personal Loans In Canada?

While traditional online payday loans often have a demanding payment schedule and high interest rates that can potentially cause a cycle of debt, a personal loan for bad credit is a financial option tailored for individuals with imperfect credit who are looking for quick financial assistance. With the option to spread repayments over 6 to 8 bi-weekly payments, you can effectively manage your expenses, addressing your immediate needs without the pressure of a lump-sum repayment. Unlike traditional lenders, our network of online lenders consider various factors beyond just credit scores, making it easier for those with less-than-ideal credit history to obtain funds.

Our application process is straightforward and convenient, making it a viable choice for quick financial assistance.

The Loan Process

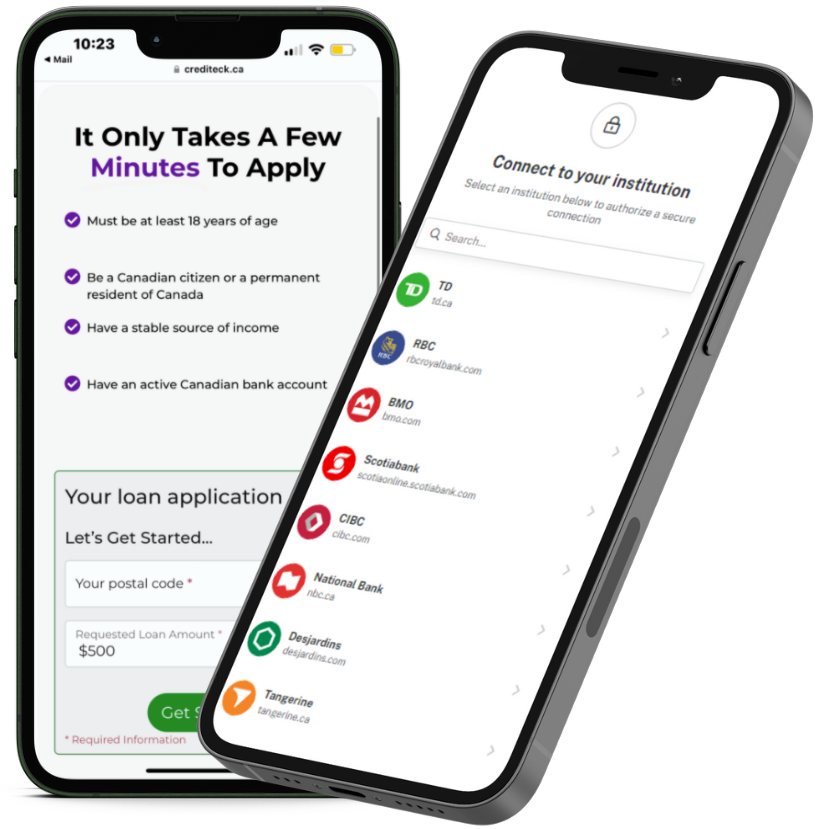

Apply Online

Use our online application, it’s easy and only takes a few minutes to finish.

Verify Details

Upon approval, you will be directed to a link to connect your bank account.

Review & Sign

Upon approval, review and sign loan offer from Lender.

Receive E-transfer

Receive money VIA E-Transfer and make scheduled payments.

Personal Loans

- Flexible Repayment

- * No Credit Check

- Use How You Want

- Instant Approval

Vs

Payday Loans

- Short Repayment

- High Interests Rates

- Cycle Of Debt

- Small Loan Amounts

In Canada, personal loans for bad credit and payday loans serve as two distinct financial products, each with its own set of characteristics and implications for borrowers. While payday loans and cash advances offer quick access to funds, they often come with high interest rates and demanding repayment schedules that can exacerbate your financial stress. Our solution provides an alternative that stands out.

Rather than relying on traditional payday loans, our network of lenders specializes in installment loans tailored for individuals with bad credit. The key difference lies in the repayment structure. With payday loans, borrowers are typically required to repay the entire borrowed amount, plus interest, in a single lump sum on their next payday. This can be financially burdensome.

In contrast, installment loans allow borrowers to spread their repayments over a more extended period, typically 6 to 8 bi-weekly payments. This approach offers a more flexible and manageable way to secure the funds you need, addressing your immediate financial needs without the pressure of a lump-sum repayment.

How we can help...

Apply For A Personal Loan Right Now.

Simply use our online application to get pre approved, If you are approved you will be redirected to an instant bank verification page to verify your details with a lender who wants to work with you.

Why choose crediteck?

Increase Your Approval Odds with our Direct Lender Network in Canada! At Crediteck, we understand the importance of securing a short-term installment loan when you need it most. That’s why we have built a strong network of direct lenders across Canada to connect you with the right loan options. When you choose Crediteck, you benefit from the following advantages:

Exclusive Lender Network

We put your application directly in front of our network of reputable lenders in Canada. By leveraging our established relationships, we increase your chances of getting approved for the loan you need

Easy Verification Process

Once you complete our online application and receive a pre-approval, we expedite the process by seamlessly redirecting you to a lender. Through instant bank verification, you can quickly and securely verify the details you have provided, ensuring a smooth loan application experience.

Trusted & Reliable

With Crediteck, you can trust that your loan application is in capable hands. We prioritize your privacy and security, adhering to strict industry standards to safeguard your personal information throughout the entire process.

.

Rates and Terms

Your loan amount, duration of loan and interest rate will be determined by the lender you are matched with.

Loans range from

$100 - $5,000

Terms from

4 - 24 Months

APRs range

29.99% - 46.96%

Cost of Credit Example

The chart below represents illustrative examples of the cost and payment schedule of a $720 personal loan.

Installment Loans: Bi-Weekly Customer = Six (6) Payments

Annual Percentage Rate

The cost of your credit as a yearly rate

32%

Finance Charge

The dollar amount the credit will cost you

$58.54

Amount Financed

The amount of credit provided to you on your behalf

$720.00

Total of Payments

The cost of your credit as a yearly rate

$778.54

Payment Schedule Based on 12/26/2023 Loan Origination

|

Payment Number

|

Amount of Payment

|

When Payments Are Due

|

|---|---|---|

|

1

|

$129.76

|

01/09/2024

|

|

2

|

$129.76

|

01/23/2024

|

|

3

|

$129.76

|

02/07/2024

|

|

4

|

$129.76

|

02/21/2024

|

|

5

|

$129.76

|

03/04/2024

|

|

6

|

$129.76

|

03/18/2024

|

* Disclaimer: This Consumer Installment Loan Rate Schedule provides an illustrative example of a typical extension of credit lenders offer to qualified applicants. The APRs noted above are for a $720 loan repayable in six bi-weekly payments. The terms listed in this Consumer Installment Loan Rate Schedule may be offered for only a limited period of time and may differ from your loan agreement. Rates are current as listed and are subject to change. The rates displayed do not represent a loan approval or commitment to lend. The actual fees, costs and monthly payment on your specific loan transaction may vary and may include additional fees and costs. You should always seek competent professional advice prior to engaging in any financial transaction.

Common Terms For

Personal Loans

Online personal loans have many “names” including installment loans, loans for bad credit, payday loans and e-transfer loans. All of these search terms are common terms while looking for a personal loan with bad credit. Click below to learn more about these different terms and why they are used while searching for financial assistance.

Installment Loans

Click to learn more about personal loans in Canada.

E-Transfer Loans

Click to learn more about E-transfer loans in Canada.

Bad Credit Loans

Learn more about bad credit loans in Canada.

Payday Loans

Click to learn more about payday loans in Canada

see what customers are saying

Trustindex verifies that the original source of the review is Google. I got approved and had money deposited in my account on same day. Fast and easy process.Trustindex verifies that the original source of the review is Google. After using a few services like this, and mostly being disappointed in the past, I can say for the first time that Crediteck was professional and the way it should be.Trustindex verifies that the original source of the review is Google. While visiting Toronto I was relieved to find Crediteck. I had some unexpected expenses and they saved the day. Great service. If I ever have the need for quick cash I would use Crediteck again