Installment Loans From $100 - $5,000

Unlock financial assistance with a seamless online installment loan. Connect with our trusted Canadian lenders, known for flexibility and often skipping credit checks. Elevate your chances of approval and take control of your finances. Your swift journey to reliable loans starts here.

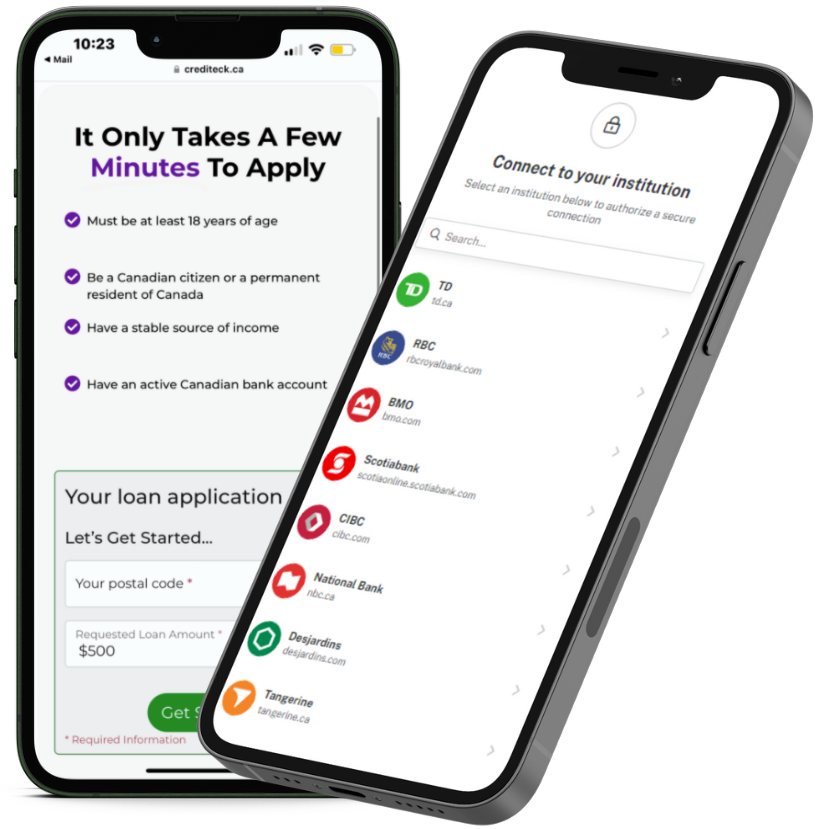

Apply Online

Use our online application, it’s easy and only takes a few minutes to finish.

Verify Details

At this step, you will be directed to a lender to verify your application details.

Review & Sign

Upon approval, review and sign loan offer from lender.

Receive E-transfer

Receive money via e-transfer or direct deposit and make scheduled payments.

- Must be at least 18 years of age

- Be a Canadian citizen or a permanent resident of Canada

- Have a stable source of income

- Have an active Canadian bank account

What is an installment loan?

Online installment loans with multiple payments in Canada refer to a type of short-term loan that allows borrowers to repay the borrowed amount and associated fees over several installments rather than in a single lump sum on their next payday. This installment structure aims to make repayment more manageable for borrowers who may find it challenging to repay the entire loan amount in one go.

APR's, terms and loan example

Loans range from $100-$5,000 with terms from 4 months to 24 Months or longer. APRs range from 29.99% to 46.96% and will depend on our partner’s assessment of your credit profile. For example, on a $1,000 loan paid monthly over 12 months at 29.99% APR, a person will pay $125.09 per month for a total of $1,501.08 over the course of the entire loan period. In the event of a missed payment an insufficient funds fee of around $45 may be charged (dependent on the lender).

How do installment loans work?

Understanding the mechanics of installment loans in Canada is essential for making informed financial decisions. An installment loan is a type of borrowing where a lender provides a borrower with a fixed sum of money, and the borrower agrees to repay the loan amount over a specific period through regular, scheduled payments. These payments, often monthly, consist of both principal and interest, allowing borrowers to manage their budget effectively. In Canada, lenders offer varying terms and conditions for installment loans, including different repayment periods and interest rates.

Who is eligible?

Eligibility for a installment loan is subject to certain criteria designed to ensure responsible lending practices. To qualify for a installment loan, individuals must meet the following requirements:

Age Requirement: Applicants must be at least 18 years old to be eligible for a installment loan. This age criterion reflects the legal age for entering into financial contracts.

Active Bank Account: A crucial prerequisite for obtaining a installment loan is to have an active bank account. This ensures a secure and efficient process for loan disbursement and repayment.

Canadian Citizenship or Permanent Residency: To be eligible for a installment loan in Canada, applicants must be either Canadian citizens or permanent residents. This requirement is in place to adhere to regulatory standards.

Active Source of Income: Applicants need to demonstrate a reliable and active source of income. This could include employment income, government benefits, or other consistent sources of funds. This criterion ensures that borrowers have the means to repay the loan.

By meeting these eligibility criteria, individuals can confidently explore installment loan options as a potential solution to their short-term financial needs. It’s important to note that responsible borrowing practices contribute to a positive lending experience for both borrowers and lenders.

What are the benefits of installment loans?

Quick Cash in a Pinch: Need money fast? installment loans are your go-to solution for those unexpected expenses that catch you off guard. Get the funds you need swiftly, so you can tackle life’s surprises without delay.

No Credit Worries: Worried about your credit score? No problem! With installment loans, your credit history is less of a concern. Even if you don’t have a perfect score, you can still access the cash you need when you need it most.

Simple Application Process: We know your time is precious. Say goodbye to lengthy paperwork and complicated processes. Applying for a installment loan is quick and easy, giving you a hassle-free experience so you can get back to what matters most to you.

Transparent Terms and Conditions: No hidden surprises here! With installment loans, you get straightforward terms and conditions. We believe in transparency, so you know exactly what to expect. Peace of mind and financial assistance – that’s the installment loan advantage.

Why apply on our website?

Opting for a loan search platform that connects an application with multiple lenders offers several advantages compared to applying directly on a single lender’s website. Here are key reasons why someone might prefer a loan search platform:

Efficiency and Time-Saving: A loan search platform streamlines the application process by allowing individuals to submit a single application that is then shared with multiple lenders. This not only saves time but also reduces the need to fill out multiple applications for different lenders separately.

Better Approval Odds: Different lenders have varying criteria for approval. A loan search platform may increase the likelihood of finding a lender whose criteria match the borrower’s profile, potentially improving approval odds, especially for individuals with diverse financial backgrounds.

Diverse Loan Options: Various lenders specialize in different types of loans or cater to specific financial situations. A loan search platform allows borrowers to explore a wide range of loan options, ensuring they find the one that best suits their specific needs, whether it’s a payday loan, installment loan, or other types of financing.

Confidentiality and Privacy: Some individuals may prefer the privacy of using a loan search platform, as it allows them to explore loan options without directly disclosing personal information to individual lenders until they choose to proceed with a specific offer.

Expertise and Guidance: Loan search platforms often provide guidance and information on different lenders and loan products. This can be valuable for borrowers who may not be familiar with the intricacies of various lending options, helping them make more informed decisions.

Types of installment loans

In Canada, installment loans come in various forms, and lenders may offer different types to cater to specific needs and preferences. Some common types of installment loans in Canada include:

E-Transfer installment Loans: E-transfer installment loans involve the electronic transfer of funds directly to the borrower’s bank account. The loan amount is deposited digitally, and repayments can also be made electronically. These loans may offer added convenience and speed, as the entire process can be conducted online.

Installment installment Loans: Installment loans allow borrowers to repay the loan amount and associated fees over multiple payments, rather than in a single lump sum on their next payday. This type of loan can be more manageable for individuals who need to spread out the repayment over a longer period.

Bad Credit installment Loans: Bad credit installment loans are designed for individuals with poor credit histories who may struggle to qualify for traditional loans. These loans often have less stringent credit requirements.

No Credit Check installment Loans: Some installment lenders offer loans without conducting a traditional credit check. Instead, they may assess the borrower’s ability to repay based on income and other factors.

Why Canadian's Love Crediteck

At Crediteck, we understand the importance of securing an installment loan when you need it most. That’s why we have built a strong network of direct lenders across Canada to connect you with the right loan options. When you choose Crediteck, you benefit from the following advantages:

- Fast online application

- Access up to $5,000

- No credit checks *

- No documents required *

see what customers are saying

Trustindex verifies that the original source of the review is Google. I got approved and had money deposited in my account on same day. Fast and easy process.Trustindex verifies that the original source of the review is Google. After using a few services like this, and mostly being disappointed in the past, I can say for the first time that Crediteck was professional and the way it should be.Trustindex verifies that the original source of the review is Google. While visiting Toronto I was relieved to find Crediteck. I had some unexpected expenses and they saved the day. Great service. If I ever have the need for quick cash I would use Crediteck again

Dont Wait...

Apply Online Now

Simply use our online application to get pre approved, If you are approved you will be redirected to an instant bank verification page to verify your details with a lender who wants to work with you.